1. Introduction

Global Distribution Systems (GDS) play a critical role in

travel technology, enabling seamless integration of various travel services

such as flights, hotels, and car rentals from multiple providers. GDS systems

offer real-time access to inventories, pricing, and availability, catering

predominantly to travel agencies, corporate travel management firms, and tour

operators. Its architecture is complex, designed to support:

- Wide

network reach

- High

transaction volume

- Secure

data exchange

- Real-time

communication across systems

Despite evolving business models and new technologies, GDS

remains a cornerstone in the travel industry’s technology ecosystem. This

article explores the architecture, components, and current relevance of GDS

within the rapidly evolving travel technology landscape.

2. Technological Evolution of GDS

The origin of GDS can be traced back to the 1960s when

American Airlines, in collaboration with IBM, developed the first GDS, known as

Sabre. Initially designed to handle airline reservations, Sabre paved the way

for other systems like Amadeus and Travelport. These systems evolved beyond

airline reservations, incorporating services such as hotel bookings and car

rentals.

Over time, GDS platforms have embraced cloud computing and

transitioned from traditional data formats like EDIFACT to modern standards

such as XML and IATA's New Distribution Capability (NDC). EDIFACT, though

crucial in GDS's early stages, restricts airlines from fully marketing their

products and services. NDC, by contrast, enhances flexibility by supporting

dynamic pricing, bundled offers, and personalized travel experiences. This

shift allows richer content and greater control over the distribution process,

benefitting both airlines and consumers.

3. Core Components of GDS

The GDS architecture comprises several key components:

Search, Booking, and Reservation System: GDS

facilitates a unified search across multiple travel service providers, ensuring

accurate inventory and availability. Its booking engine manages complex

pricing, scheduling, and availability rules across different suppliers,

handling the complete booking lifecycle, including cancellations and

modifications.

Data Processing: With thousands of

transactions processed per second, GDS requires robust data processing

capabilities to ensure fast and reliable communication between suppliers and

agents.

APIs and Integration: Modern GDS platforms provide

extensive API support, allowing seamless integration with third-party systems

like travel apps and websites. APIs enable developers to access flight

schedules, availability, and booking systems, extending GDS functionality.

Payment and Settlement: GDS platforms handle payments

through integrated payment gateways, facilitating the secure collection and

disbursement of funds. They also generate invoices and receipts for service

providers and customers.

Reporting and Analytics: GDS platforms offer

reporting and analytics features, allowing stakeholders to analyze booking

trends, sales, and market dynamics. This data is invaluable for travel agents

and service providers in optimizing their strategies.

4. Overview of GDS Integration Architecture

Figure 1: Integration Architecture of GDS

The integration architecture (Figure 1) of GDS is a

sophisticated system that connects various modules to facilitate efficient

travel bookings and data management. Key components include:

- Central

Reservation System (CRS): The central hub of GDS, where inventory,

pricing, and availability are stored and updated in real-time by airlines,

hotels, and other travel service providers.

- APIs:

APIs allow real-time data exchange between GDS and external platforms,

enabling travel agents and online travel agencies (OTAs) to seamlessly

access data.

- Databases:

GDS relies on highly scalable databases to store vast amounts of

information, including customer data, booking details, and supplier

inventories.

- User

Communication Interface: Initially, GDS platforms utilized

command-line interfaces for travel agents. However, these systems have

evolved to offer more user-friendly graphical interfaces, enhancing

usability. Examples include Amadeus's Selling Platform Connect and Sabre

Red.

5. GDS in Action: Airline and Hotel Bookings

Figure 2: GDS and CRS Integration

GDS seamlessly integrates with airlines' and hotels' CRS

systems (Figure 2) to access availability data and manage reservations. In a

multi-segment booking scenario involving multiple airlines and a hotel, the GDS

holds the complete itinerary, while each service provider maintains relevant

segments. For instance, if a passenger books an itinerary containing air

segments of multiple airlines and hotel booking through a travel agency, the

PNR (Passenger Name Record) in the GDS system would hold information on their

entire itinerary, while each airline they fly on and the hotel they stay would

only have a portion of the itinerary that is relevant to them. This would

contain flight segments on their services and inbound and onward connecting

flights (known as info segments) of other airlines in the itinerary. Let’s say

a passenger books a journey from Mumbai to Hongkong on Cathay Pacific, Hongkong

to Vancouver on Air Canada, and Vancouver to New York on Delta and a hotel stay

in New York at Marriot through a travel agent, and if the travel agent is

connected to Amadeus GDS, the PNR in the Amadeus GDS would contain the full

itinerary, while the PNR in Cathay Pacific would show the Mumbai to Hongkong

segment along with the Air Canada flight as an onward info segment. Likewise,

the PNR in the Delta system would show the Vancouver to New York segment with

the Air Canada flight as an arrival information segment. Finally, the PNR in

Air Canada’s system would show all three segments, one as a live segment and

the other two as arrival and onward info segments. Marriot CRS will store the

passenger's hotel reservation details. This is illustrated in Figure 3.

Figure 3: GDS and CRS PNR System in a Multi-Segment Journey

6. Relevance of GDS in Modern Travel

Global Reach: GDS systems provide unparalleled global

connectivity, giving travel agencies—both traditional and online—access to a

wide range of suppliers. This allows customers to compare prices and

availability in real-time across numerous travel service providers.

Efficiency: GDS enables quick comparison of flight

schedules, room availability, and pricing, making the booking process faster

and more efficient. Real-time updates ensure that travel agents have the latest

information regarding availability and pricing.

Revenue Generation: For travel agencies, GDS is a

significant source of revenue, integrating commissions and booking fees into

the platform. Dynamic pricing models can also maximize revenue based on demand.

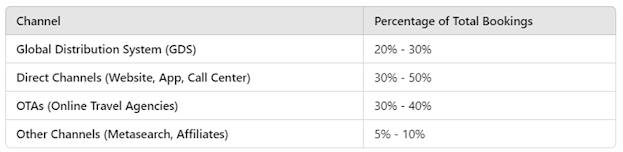

For many hotels, GDS remains a major contributor (Table 1) to their overall

revenue.

7. Challenges and Future Directions

Current Challenges: Despite its advantages, GDS faces

increasing competition from direct booking channels, where travellers can

bypass intermediaries. Low-cost carriers often avoid GDS due to high

subscription fees, opting for direct sales to reduce costs. Additionally, the

GDS workflow is complex and requires specialized training.

Future Prospects: The future of GDS will likely see

deeper integration with artificial intelligence, predictive analytics, and

personalization engines. As the travel industry recovers post-pandemic, GDS

will continue to play an essential role in demand management, price optimization,

and streamlining operations in an increasingly digital-first world.

8. Conclusion

GDS is a great tool for disposing of inventory last

minute, adding to the revenue of Hotels and Airlines. However, the architecture

of GDS is complex and requires heavy expenditure in IT infrastructure (cloud

cost) and operations from the GDS providers, as it requires enabling efficient

and real-time communication between suppliers and agents while providing

travelers with the convenience of accessing a wide range of services. These

costs are subsequently passed on to the travel service providers in terms

of brokerage or subscription charges. This leads, the airlines and hotels to

explore a new business model of direct selling to their wholesale and retail

customers, moving away from GDS. To reduce the cost of maintaining GDS and

ultimately pass on the benefit to the service providers, some travel tech

companies establishing significant offshore capability. Also, as GDS platforms

evolve and integrate new technologies like AI and predictive analytics to make

it smart to offer a personalized experience, their relevance in the travel

domain will continue to grow, offering both opportunities and challenges in the

rapidly changing landscape of global travel.

No comments:

Post a Comment